Indian Obsession with Gold

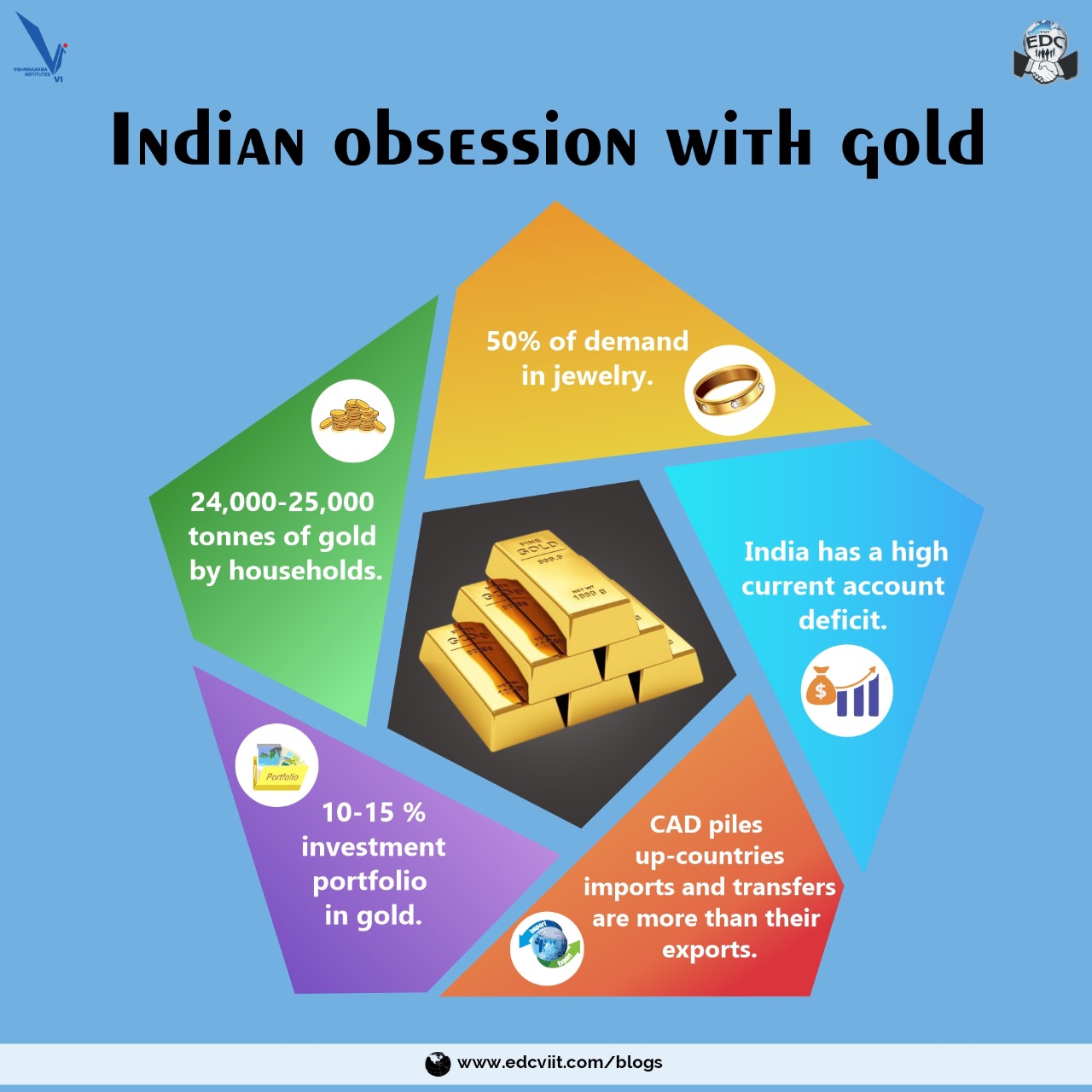

Every Indian household is well aware of the great value associated with gold in the society. We Indians have this very strange fascination with gold and it isn’t something we picked up recently but it has been an integral part of almost all Indian traditions and festivals. The Hindu calendar in 2019 had a total of 21 auspicious weddings and the World Gold Council considered it a crucial factor that drove the demand globally. According to some estimates, India has a stock of about 24,000-25,000 tonnes of gold which is mostly held by households, thus earning them the title of the world’s largest holders of the metal, according to the World Gold Council. The net reserves are close to 40% of India’s GDP(FY19).

Gold previously had a very important part to play when countries tied their currencies to their gold reserves. In simple terms, it meant that the currency note is a certificate or a token for a specific amount of gold to be held by the reserve banks. This system made the world economy highly reliant on gold. Later due to the financial burden of World War 2 governments took their currencies off this system.

Indians have a saving mindset and thus save close to 30% of their savings on an average.“They(Indians) generally hold about 10-15 percent investment portfolio in gold," said Surendra Mehta, National Secretary, India Bullion and Jewellers Association (IBJA).

All Indians, irrespective of the economic strata they belong to, dream of investing in gold. There are schemes throughout the country to help the poorer segment of the Indian society to have their share of gold. 50% of the demand for gold is in terms of jewelry. The Indian families have to mentality to keep invest a small quantity of gold over time because of its significance in Indian customs and traditions.

Gold has a store of value which means that it can be exchanged or chased in for value even at the local jewelry store. How would an asset like gold fare in uncertain times like the COVID-19 pandemic? Data suggests that the price per 10 gram of gold corrected by 3.2% in March, nonetheless it remained over Rs 40,000 per 10 gram. During the January to March 2020 quarter, gold gained nearly 5%.

The pandemic sent the banking system into a disarray forcing people to rely on the trusted precious metal for the loan. Not only is the general public but also the farmers are turning to gold loans because of the ease and the lower rate of interest.

The uncertainty in the other avenues of investment like stocks, bonds, etc further adds value to gold. This in turn helps the middle class have a substantial currency available. Majority of families surely do invest in these sectors for future benefits.

We as a society have gold as an important part of our customs and traditions. It might seem hard for someone on the outside to comprehend the reason behind this huge demand but we understand it since we know what our culture and traditions mean to us. In a way this could be looked at as a boon because it pushes us to invest our savings in an ever-growing asset but how does playout for the nation? In the current situation, India has a high current account deficit (CAD). The number one reason for this is our oil imports and the next on the list is gold. India has a huge CAD bill because of its heavy gold imports. CAD piles up when countries imports and transfers are more than their imports.

You might have been able to see how this commodity has an overall impact on not only your life but also the entire financial system.